Delve into the world of Financial Lifestyle Planning for Millennials and Gen Z, where strategic financial decisions pave the way for a secure future. This insightful discussion sheds light on the unique challenges and opportunities faced by these generations in today's evolving economy.

From budgeting techniques to investment choices, this guide offers valuable insights on navigating the complexities of financial planning in a digital age.

Overview of Financial Lifestyle Planning for Millennials and Gen Z

Financial lifestyle planning refers to the process of setting financial goals, creating a budget, saving, investing, and managing debt to achieve a desired lifestyle both now and in the future.

For Millennials and Gen Z, financial planning is crucial as they navigate a rapidly changing economy, rising living costs, and uncertain job markets. By planning their finances effectively, they can build a secure financial future and achieve their long-term goals.

Financial Challenges Faced by Millennials and Gen Z

Both Millennials and Gen Z face unique financial challenges in today's economy. Millennials often struggle with student loan debt, high housing costs, and stagnant wages. On the other hand, Gen Z is entering the workforce during a time of economic uncertainty, making it challenging to secure stable employment and plan for the future.

Key Differences in Financial Goals Between Millennials and Gen Z

- Millennials often prioritize paying off student loans and saving for a down payment on a home.

- Gen Z, on the other hand, focuses on building an emergency fund, investing in sustainable and ethical companies, and saving for experiences such as travel.

- Both generations value financial independence and aim to achieve a work-life balance that aligns with their values and goals.

Strategies for Financial Lifestyle Planning

Budgeting is a crucial aspect of financial lifestyle planning for Millennials and Gen Z. Here are some examples of budgeting techniques suitable for these generations:

1. Track Your Expenses

- Create a detailed list of all your expenses to understand where your money is going.

- Utilize budgeting apps like Mint or YNAB to track your spending habits and set financial goals.

2. Embrace the 50/30/20 Rule

- Allocate 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment.

- This rule helps you prioritize essential expenses while leaving room for discretionary spending and saving.

Role of Technology in Managing Finances

Technology plays a significant role in helping Millennials and Gen Z manage their finances effectively.

- Online banking and budgeting apps provide real-time insights into spending patterns.

- Automation tools can help set up automatic transfers for savings and investments, making it easier to stay on track with financial goals.

Comparison of Traditional Investment Options with Cryptocurrency

- Traditional investments like stocks and bonds offer stability and long-term growth potential.

- Cryptocurrency, while more volatile, presents opportunities for high returns but comes with higher risk.

- Diversification is key - consider a mix of traditional and newer investment options to balance risk and reward.

Understanding Passive Income for Millennials and Gen Z

- Passive income involves earning money with minimal effort or active involvement.

- Examples include rental income, dividends from investments, and affiliate marketing.

- Generating passive income streams can provide financial stability and flexibility, allowing for more freedom in pursuing personal goals.

Financial Education and Awareness

Financial education is crucial for Millennials and Gen Z to make informed decisions about their finances. With the rise in student loans and the ever-changing financial landscape, it is more important than ever for these generations to be financially literate.

Impact of Student Loans

Student loans can have a significant impact on financial planning for Millennials and Gen Z. The burden of student debt can delay major life milestones such as buying a house or starting a family. It is essential for individuals in these generations to understand how student loans affect their overall financial health and plan accordingly.

Resources for Financial Education

There are various resources available tailored to Millennials and Gen Z to improve their financial literacy. Online platforms, workshops, and courses specifically designed for young adults can provide valuable information on budgeting, investing, and managing debt. Utilizing these resources can help individuals make more informed financial decisions.

Tips for Staying Informed

To stay informed about financial trends and opportunities, Millennials and Gen Z can follow reputable financial news sources, subscribe to finance-related podcasts or newsletters, and attend financial literacy events. Engaging with financial content regularly can help individuals stay up-to-date on the latest developments in the financial world and make better financial choices.

Balancing Lifestyle Choices with Financial Goals

Finding the right balance between enjoying life today and securing your financial future is crucial for Millennials and Gen Z. By making mindful spending choices and setting realistic financial goals, it is possible to achieve both a fulfilling lifestyle and financial stability.

Examples of Balancing Experiences and Saving

One way to balance spending on experiences and saving for the future is by creating a budget that allocates a specific amount for both categories. For instance, you can set aside a portion of your income for savings, investments, and emergency funds, while also allowing yourself to enjoy occasional experiences like dining out or traveling.

Mindful Spending for Financial Planning

Mindful spending involves being conscious of where your money goes and making intentional decisions about your purchases. By practicing mindful spending, you can avoid impulse buys, prioritize spending on things that truly matter to you, and align your expenses with your financial goals.

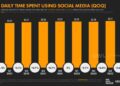

Influence of Social Media on Financial Decisions

Social media can have a significant impact on the financial decisions of Millennials and Gen Z. The pressure to keep up with trends, influencers, and peers can lead to overspending on unnecessary items. It is important to differentiate between genuine needs and wants, and not let social media influence your financial choices.

Tips for Setting Realistic Financial Goals

- Start by assessing your current financial situation, including income, expenses, debts, and savings.

- Identify short-term and long-term financial goals that are specific, measurable, achievable, relevant, and time-bound (SMART).

- Break down larger goals into smaller milestones to track your progress and stay motivated.

- Regularly review and adjust your financial goals as your circumstances change.

Last Point

As we wrap up our exploration of Financial Lifestyle Planning for Millennials and Gen Z, remember that informed decisions today shape the financial landscape of tomorrow. Empower yourself with knowledge and proactive strategies to achieve your desired lifestyle goals.

FAQ

What are some key differences in financial goals between Millennials and Gen Z?

Millennials often prioritize student debt repayment and homeownership, while Gen Z tends to focus on building emergency savings and investing in experiences.

How can Millennials and Gen Z balance spending on experiences with saving for the future?

One approach is to allocate a set percentage of income for experiences while also setting aside a portion for savings and investments to maintain a healthy financial balance.

What role does technology play in managing finances for Millennials and Gen Z?

Technology offers convenient tools for budget tracking, goal setting, and investment management, empowering these generations to stay on top of their financial health.

How can Millennials and Gen Z stay informed about financial trends and opportunities?

Engaging with reputable financial news sources, attending seminars or webinars, and networking with finance professionals are effective ways to stay updated on the latest trends and opportunities.